NY DTF TP-584.1 2019-2026 free printable template

Show details

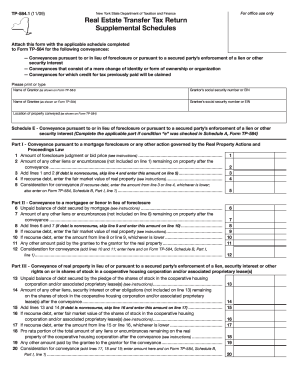

TP584.1 (7/19)For office use onlyDepartment of Taxation and Financial Estate Transfer Tax Return Supplemental SchedulesAttach this form to FormTP584 or TP584NYC with the applicable schedule completed.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tp584 form

Edit your tp584 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tp 584 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tp 584 form online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tp 584 form ny. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF TP-584.1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nys form tp 584

How to fill out NY DTF TP-584.1

01

Start by downloading the NY DTF TP-584.1 form from the New York State Department of Taxation and Finance website.

02

Fill in the basic information, including your name, address, and the tax year your form pertains to.

03

Provide details about the property being transferred, including its address and the date of transfer.

04

Indicate the reason for the transfer in the designated section.

05

Ensure that you include the correct identification numbers for all parties involved in the transfer.

06

Review the completed form for accuracy, making sure all required fields are filled in.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the completed form according to the submission guidelines provided by the New York State Department of Taxation and Finance.

Who needs NY DTF TP-584.1?

01

Individuals or entities involved in the transfer of real property in New York State.

02

Property sellers who are responsible for filing this form as part of the transfer process.

03

Buyers who need to ensure proper tax documentation for their property acquisition.

Fill

tp 584 1 schedule f

: Try Risk Free

People Also Ask about tp584 1 fill in

What is NY TP 584 fee?

The tax is computed at a rate of two dollars for each $500 of consideration or fractional part thereof. An additional tax (Part 2 of this schedule) is imposed on the conveyance of residential real property where the consideration for the entire conveyance is $1 million or more.

How do I avoid transfer tax in NYC?

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

What is the penalty for real property transfer tax in NYC?

If the value is $500,000 or less, the rate is 1% of the price. If the value is more than $500,000 the rate is 1.425%.

What is the penalty for transfer tax in NY?

The penalty charge is: 5% of the tax due for each month (or part of a month) the return is late, up to a maximum of 25%

How do I avoid transfer tax in NY?

How To Avoid Paying NYC Transfer Tax? The only way to avoid paying NYC transfer tax is by selling your property through a 1031 exchange. A 1031 exchange allows investors to defer capital gains taxes on investment properties by reinvesting the proceeds from the sale into another qualifying property.

What is Form TP 584 NYC?

Form TP-584-NYC must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tp 584 fillable to be eSigned by others?

When you're ready to share your form tp 584, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the tp584 form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your form tp 584 1 in seconds.

How do I fill out tp 584 1 fill in form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tp584 ny and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY DTF TP-584.1?

NY DTF TP-584.1 is a form used in New York State for the reporting of the transfer of real estate, specifically for residential property transactions. It is used to document the details of the transfer and assess applicable taxes.

Who is required to file NY DTF TP-584.1?

The form NY DTF TP-584.1 must be filed by the grantor (seller) or their representative when there is a transfer of real property in New York State, which includes individual sellers, partnerships, corporations, and other entities.

How to fill out NY DTF TP-584.1?

To fill out NY DTF TP-584.1, you need to provide detailed information about the parties involved in the transaction, the property being transferred, the nature of the transfer, and any applicable exemptions. Ensure all sections are completed accurately before submission.

What is the purpose of NY DTF TP-584.1?

The purpose of NY DTF TP-584.1 is to provide the New York State Department of Taxation and Finance with information regarding real property transfers, which is necessary for the assessment of transfer taxes and maintaining public property records.

What information must be reported on NY DTF TP-584.1?

The information that must be reported on NY DTF TP-584.1 includes the names and addresses of the grantor and grantee, a description of the property, the type of deed, details of any exemptions claimed, and the purchase price or consideration paid for the property.

Fill out your NY DTF TP-5841 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

tp584 New York is not the form you're looking for?Search for another form here.

Keywords relevant to pdffiller

Related to tp 584 schedule f

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.